Boeing (BA -1.91%) and Delta Air Lines (DAL -0.26%) have much in common, but their differences matter enough to make one stock a buy and the other worth avoiding. Here’s a look at both companies and why one is much more attractive than the other.

Flight departures are in recovery mode

The airline industry is on a steady path to recovery, with robust revenue and profit growth projected for 2024. The International Air Transport Association’s (IATA) latest industry forecasts further bolster this optimistic outlook. The IATA anticipates $996 billion in airline revenue in 2024, a 9.7% increase from the previous year. Global airline net profits are projected to increase by 11.1% to reach $30.5 billion in 2024, significantly surpassing IATA’s prior forecast of $25.7 billion for 2024.

There’s no denying the airline industry’s upward trajectory, which bodes well for Delta Air Lines and Boeing. A thriving commercial flight market translates to increased ticket revenue and capacity expansion for Delta, while the industry’s growing profitability signals a surge in orders for Boeing.

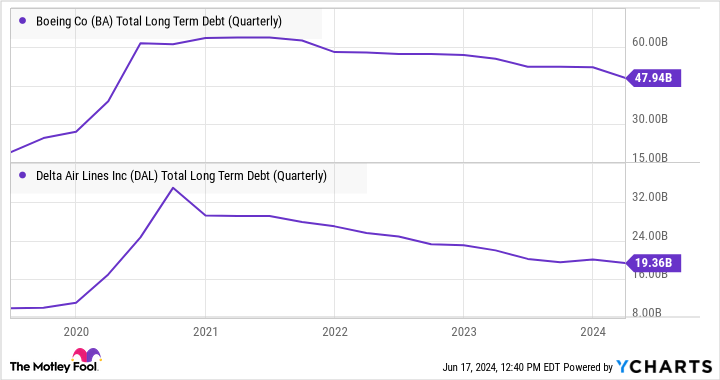

The positive industry outlook is a boon for the airline industry and a perfect opportunity for Delta and Boeing to generate the cash flow needed to reduce their debt levels. This, in turn, will put them in a solid financial position to create long-term value for their shareholders.

BA Total Long Term Debt (Quarterly) data by YCharts

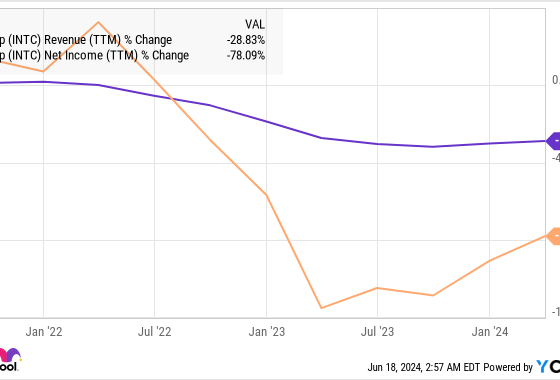

Boeing’s difficult earnings trajectory

However, this is where the similarity ends, and the differences become apparent. Simply put, Delta is on track with its medium-term aims, and Boeing is not. Moreover, growing evidence suggests that Delta’s momentum is improving while Boeing’s is slowing.

As previously discussed, a growing number of headwinds brewing for Boeing are working against it hitting its target of $10 billion in free cash flow (FCF) in 2025/2026. Indeed, CFO Brian West has already told investors that 2024 will be a year of cash burn for the company, and Wall Street analysts don’t believe Boeing will hit its FCF target in 2026.

If it isn’t quality control issues causing airplane delivery delays, it’s a defense business that still isn’t consistently profitable as it works through problematic fixed-price development projects such as Air Force One. If it isn’t the threat of costly labor contract negotiations, it’s the potential cash drain of supporting suppliers like Spirit AeroSystems.

If it isn’t the possibility that airlines will demand compensation for the damage done to their capacity expansion plans by airplane delivery delays, it is a chance that Boeing will need to discount pricing on new planes as delivery dates get pushed out.

Boeing isn’t delivering on its potential, and its problems are mounting.

Delta is delivering

In contrast, Delta Air Lines remains on track with its strategic objectives to generate up to $4 billion in FCF in 2024 while growing its premium-related revenue as part of an increasing focus on higher-income travelers. It’s not just about growing its more lucrative premium (business and first class) revenue; it also relates to its fast-growing remuneration from American Express, which comes from spending on co-brand American Express credit cards.

Focusing on higher-income passengers also implies attracting more to sign up for credit cards to take advantage of Delta’s SkyMiles program. Moreover, the SkyMiles loyalty program improves customer relations and encourages them to use Delta.

The airline’s premium ticket revenue grew 10% in the first quarter compared to main cabin growth of 4% and overall passenger revenue growth of 7%, demonstrating its ongoing shift to premium-related revenue. Management plans to get its premium and “loyalty and other” revenue to a combined share of 60% of revenue over the long term, compared to 56% in 2023.

For reference, Wall Street’s expectation that Delta will earn $4 billion in net income in 2024 represents a whopping 13.1% of $30.5 billion in total global airline net profits forecast by the IATA.

Delta Air Lines stock or Boeing stock?

If you believe in the commercial aerospace recovery and are looking for a stock to benefit from it, Delta is a better choice than Boeing. The airline’s cash generation will help it reduce debt, and the shift to premium is fast-growing remuneration from American Express, which is a significant plus and improves the quality of its earnings.

In contrast, Boeing is falling behind in its plans, and uncertainty is growing over its medium-term financial targets.