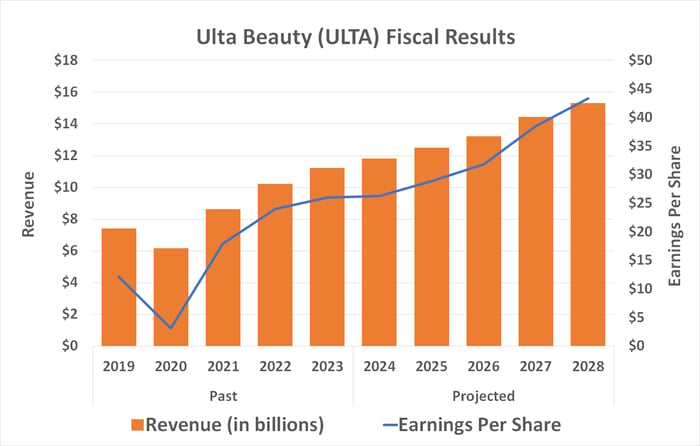

It’s been a tough past few months for Ulta Beauty (ULTA -1.69%) and, by extension, for shareholders. Although the stock started the year out on a bullish foot, it has fallen steeply from its March peak thanks to a combination of competition and continued inflation. Namely, after sales growth slowed to a crawl in the fiscal 2024 first quarter (ended May 4), the cosmetics and skincare retailer lowered its full-year revenue guidance. Investors are understandably worried.

The sellers, however, have arguably overshot their target. At the same time, the narrative surrounding the company has also turned unnecessarily pessimistic. Analysts’ current consensus price target of $487.90 is 28% above the stock’s present price, suggesting its pullback is ultimately a buying opportunity. Investors just have to look further down the road to see the bigger picture.

Three arguments for owning Ulta Beauty stock

While there are still challenges for Ulta to overcome, the growth headwinds the company presently faces are temporary.

Inflation is a big one. While May’s inflation rate of 3.3% was above the Federal Reserve’s long-term target of 2%, it came in slightly lower than expected. The Federal Reserve now has plans for a single rate cut this year, which will start to give consumers some relief.

On the competition side, Sephora is Ulta’s main rival, according to Jefferies. The firm downgraded Ulta in April, citing its competitor’s stepped-up sales efforts. Ulta CEO Dave Kimbell also acknowledged recently that competitors have taken a bite out of the business.

As a result, the retailer is reorganizing its stores to sell higher-priced items side by side with less expensive products, for instance, while at the same time investing in its nascent digital capabilities. In fact, the computer network in use by its stores for years was only recently retired and replaced by something more modern.

Last but not least, Ulta Beauty aims to do more with its loyalty and rewards program than it has up to this point.

Ulta Rewards has always been a bright spot for the retailer. As Motley Fool contributor Jon Quast recently pointed out, 95% of the company’s sales come from members of its loyalty program. Though repeat business is important, the company is now increasing its efforts to promote all the benefits of being a member.

Sooner than later is better

Again, there are risks. Take its growing competition as an example. Ulta can’t prevent partnerships like the one between Sephora and Kohl’s from taking shape, just as it can’t prevent brands such as e.l.f. Beauty from offering value-minded cosmetics options directly to consumers. Ulta can only respond by altering its own product mix, presence, and pricing strategy. It can take time to see the impact — if any — of such changes. It’s also not always clear how much time it will take to see any positive impact from these efforts, further frustrating investors.

Now, take a step back and look at the bigger picture. Ulta Beauty is a tremendous brand name. There’s no other retailer out there quite like it. There’s no other brand out there even in a position to become much like Ulta, in fact, which dominates the ever-popular strip mall space with over 1,200 stand-alone stores.

Admittedly, the company wasn’t entirely ready for the headwinds that began blowing just a few quarters ago. But it’s not like Kimbell is incapable of orchestrating a response. He’s responding by leveraging the company’s existing strengths. He’s also leading the revival of a company that isn’t bogged down by any debt. Yes, Ulta Beauty is debt-free, further separating it from competitors that may not enjoy as much fiscal flexibility.

The kicker: You can step into Ulta stock while it’s priced at only about 15 times its trailing-12-month earnings. That’s as cheap as its valuation has been in years. It’s no wonder analysts are still so bullish on the stock despite the company’s current challenges.

That said, it’s worth noting this stock is no longer pulling back like it did in March and April. If anything, it’s found its footing for the time being, so if you’re interested, stepping into a long-term position in Ulta Beauty stock should probably happen sooner rather than later.